HPL Associate Gabriela Sepúlveda explores how artificial intelligence is emerging as a key enabler of climate and sustainability solutions in Latin America and the Caribbean. Drawing on sector specific examples across agriculture, nature conservation, energy, water, and finance, the article examines how AI can strengthen resilience, improve resource efficiency, and support climate mitigation and adaptation efforts across the region.

Transition finance is gaining attention as a key mechanism for supporting climate-aligned growth in high-emitting sectors. In this blog, Analyst Fernanda Benítez explores the role of transition finance in emerging markets, where economic expansion and rising emissions converge. She highlights the opportunity to align development with decarbonization, examines the barriers slowing capital flows, and presents international frameworks that are helping to structure credible pathways to net zero.

HPL Analyst Brenda Aguilar authored a blog post examining the rise of blue finance for the ocean as a key mechanism to mobilize capital for ocean conservation and sustainable economic growth. The article explores how instruments such as blue bonds, parametric insurance, and debt-for-nature swaps are driving measurable environmental and social impact, supported by global frameworks from the UNEP FI and the IFC. Through case studies from Seychelles, the Mesoamerican Reef, and Belize, the post highlights both the opportunities and barriers shaping this emerging market and underscores how ocean Finance can transform the ocean into a resilient, investable asset that supports communities, ecosystems, and long-term climate goals.

Biodiversity underpins over half of global GDP, making nature loss a core financial issue. In this blog, Associate, Natalia Velázquez, describes the importance of preserving biodiversity and the strategic role of financial institutions in mobilizing capital for biodiversity conservation. In addition, Natalia highlights instruments and case studies (BBVA Colombia and Davivienda biodiversity bonds, Chile’s SLB nature KPI), and outlines how banks are integrating TNFD and managing nature-related risks.

HPL Associate, Gabriela Sepúlveda, authored a blog post exploring how high-emitting industries shape Latin America’s climate transition, with the mining sector at the center of the discussion. The article outlines the sector’s strategic role in supplying critical minerals, assesses the opportunities and barriers to decarbonization, and integrates perspectives from industry leaders and regional experiences — including insights shared by Pablo Contreras, Head of Climate Action; Alejandro Sanhueza, Vice President of Finance; and Gabriel Méndez, Vice President of Corporate Affairs and Sustainability at CODELCO, as well as Marcela Boccheto, Climate Change and Sustainability Integration Senior Executive, and Nicolás Arriagada, Decarbonization Specialist at Anglo American Chile. It also highlights the potential of thematic financing instruments to bridge the investment gap and drive a credible pathway toward sustainability.

HPL Analyst, Fernanda Benítez, authored a blog post exploring the role of biodiversity credits as an emerging tool to finance conservation within the sustainable finance ecosystem. The article explains how biodiversity credits are being piloted across different regions as a way to channel much-needed private capital into conservation. It outlines how biodiversity credits are defined, how they work, and how they differ from carbon credits, while also emphasizing the importance of strong standards and governance. The post highlights real-world initiatives illustrating diverse approaches to biodiversity credit design and implementation. It also discusses opportunities and challenges ahead, from the risk of greenwashing to the need for direct conservation funding. By examining these emerging practices, the article reflects on how biodiversity credits could help bridge the biodiversity financing gap if designed responsibly, complementing, but not replacing, existing conservation efforts.

HPL Analyst, Brenda Aguilar, authored a blog post examining the emergence of green equity as a new financing tool within the sustainable finance ecosystem. The post explains how green equity designations—labels granted by stock exchanges to shares of companies that meet specific environmental criteria—are gaining momentum as a complementary alternative to green bonds. It outlines the foundational principles behind these designations, showcases early adoption by exchanges like Nasdaq, B3, and SIX, and explores both the opportunities and structural barriers that currently shape their development. The article also highlights two early case studies, SABESP in Brazil and Lamor Corporation in Finland, to illustrate how the framework is being implemented in different regulatory contexts.

Birds are often considered “barometers of the environment” due to their ability to provide valuable insights into the health and sustainability of ecosystems. As highly sensitive creatures, birds respond to changes in their habitats, such as shifts in climate, food availability, and pollution levels. In this blog post, our Associate, Natalia Velázquez, delves into how birds are much more than just beautiful, colorful creatures, they serve as sentinels of the state of the ecosystems we depend on. This article includes real-life case studies demonstrating why birds are effective indicators of environmental health.

HPL Analyst, Sofía Saldívar, authored a blog post where she explores the growing opportunities from Debt-for-Nature Swaps (DFNS) as a way to tackle both fiscal and environmental challenges in developing countries. The article explains how DFNS can help restructure national debt in exchange for environmental commitments, and highlights key case studies in Latin America and the Caribbean, along with prospects and challenges of these financial structures.

HPL Analyst, Fernanda Benítez, examines key strategies to enhance the credibility of Sustainability-Linked Bonds (SLBs) and strengthen investor confidence in sustainable finance. This latest article provides actionable recommendations for issuers on structuring SLBs with strong KPIs, ambitious SPTs, science-based targets, and meaningful financial mechanisms to ensure accountability and long-term impact.

HPL Analyst, Luis Wagner, explores the transformative role of parametric insurance in enhancing climate resilience for smallholder farmers in Latin America and the Caribbean. This latest article examines how these financial instruments provide swift and transparent payouts, helping farmers recover from climate shocks and invest in sustainable practices. As highlighted in the piece, “To effectively support smallholder farmers, financial tools must offer both immediate relief and long-term resilience”, emphasizing the need for accessible and innovative risk management solutions in the agricultural sector.

Transitioning to net zero by 2050 has become a global commitment and a challenge that involves every actor of the economy, including companies and financial institutions. In this blog, Associate, Natalia Velázquez, explores the strategic role of financial institutions in shaping corporate transition plans, and presents practical guidance for companies to develop credible net zero transition plans that align with financial institutions’ net zero targets. This blog describes the key principles and elements companies should incorporate into their plans.

HPL Analyst, Brenda Aguilar, authored a blog post exploring the crucial role of Indigenous youth in biodiversity conservation and climate justice. The post highlights the deep connection Indigenous youth have with the land and their unique ability to integrate traditional ecological knowledge (TEK) with modern approaches to environmental preservation. It also discusses the challenges these communities face, such as limited access to resources, technology, and education, while emphasizing the importance of empowering Indigenous youth to lead climate adaptation and conservation efforts. The article underscores the need for global recognition of Indigenous knowledge in climate policies and the role of sustainable financing in supporting these initiatives.

HPL Analyst, Fernanda Benítez, authored a blog post discussing the potential for sustainable investment in Latin America and the Caribbean, focusing on blended finance and Nature-Based Solutions (NbS). The article explores how these innovative financial mechanisms can help overcome the region’s challenges, including biodiversity loss and climate vulnerability. It highlights the synergy between blended finance and NbS, emphasizing their role in attracting investment for large-scale environmental projects and fostering public-private partnerships. The blog post also stresses the importance of these approaches in driving sustainable growth and resilience in emerging markets.

HPL analyst, Sofía Saldívar, authored a blog post about circular economy to achieve net zero. The article provides an explanation of circular economy and the importance of the model for achieving the goal of zero emissions. Furthermore, it highlights the key role of the financial sector in promoting transition and increasing climate resilience.

HPL Analyst, Luis Wagner, authored a blog post analyzing the landscape of electric vehicles and the role of sustainable finance in scaling the implementation of the technology. The post includes a review on the main recent pinpoints of the development of EVs and the challenges that we face toward greening the transportation sector.

HPL associate, Pedro Paniagua, authored a blog post about the importance of good governance in the climate transition for financial institutions in Latin America and the Caribbean (LAC). The blog highlights how effective governance is key to the success of transition strategies towards a net-zero economy, with a special focus on LAC markets. Learn more about this topic by reading his article.

HPL Analyst, Brenda Aguilar, authored a blog post exploring Fintechs’ role in driving the transition to a more sustainable financial system. The post highlights several ways Fintechs integrate sustainability into their business models through advanced technologies. It also mentions specific examples of Fintechs making positive environmental and social impacts, while addressing the main challenges and opportunities for these companies.

HPL associate, Daniela Canevaro, authored a blog post about climate resilience. This blog explores the concept of climate resilience and its critical role in finance. It highlights how financial institutions can use various tools and strategies to assess climate risks, identify financing opportunities, and support communities and businesses in adapting to the challenges of a changing climate.

Alongside IDB Invest, HPL co-authored the updated version of the Practitioner’s Guide and Toolkit for Thematic Bonds published in 2021.The new guide provides a practical roadmap for issuers by outlining the key steps for structuring and issuing green, social, sustainability and sustainability-linked bonds, reflecting new insights, lessons learned, and challenges in the thematic bond market over recent years. The guide is available for download in English.

During Felaban’s II Sustainable and Inclusive Banking Congress, Enlaces LAC was launched, a network that brings together different sustainable finance initiatives in the region. One of these initiatives was the First Survey on the State of Sustainable Finance in Latin American and Caribbean Banking, which was developed by HPL in collaboration with IDB Invest and Insight LAC. In 2023, we surveyed more than 100 banks in 23 countries in the region, covering critical issues related to sustainability.

Understanding and managing climate risks is critical for the future of financial institutions. In this article, HPL Analyst Natalia Velázquez, explores the complexities of physical and transition risks and offers strategic approaches on how financial institutions can manage them. This blog post also provides a list of publicly available guidance materials and tools to help assess climate risks.

HPL Analyst, Sofía Saldívar, authored a blog post entitled Sustainability in Sports: the Environmental and Social Impact of Running. The post includes an analysis of the social and environmental impact of one of the most popular sports in the world, challenges and opportunities of incorporating sustainability in major running events, and a reflection on actions that can be taken to improve socio environmental responsibility at different levels.

HPL Analyst, María Fernanda Benítez, authored a blog post that analyzes the importance of harmonizing taxonomies in the context of sustainable finance in Latin America and the Caribbean. This publication provides a definition of taxonomies, describes the challenges arising from the lack of global sustainability standards, and highlights the benefits resulting from this harmonization.

The Jamaica Stock Exchange published the Green, Social, Sustainability and Sustainability-Linked (GSS+) Bond Guide for Jamaica. This guidance document is a result of a cooperation between the Jamaica Stock Exchange and the Inter-American Investment Corporation with technical support provided by HPL.

The purpose of this guide is to provide the Jamaican market with tools for the issuance of GSS+ bonds and promote the advancement of sustainable finance in the country.

HPL Analyst, Luis Wagner, authored a blog post reviewing the implementation of Distributed Energy Resources in Latin American and the Caribbean. The post includes a review of policy and financial gaps which hinder the further development of the technology and successful initiatives in the region.

HPL Analyst, Brenda Aguilar, authored a blog post reviewing global sustainability standards and disclosure frameworks and the consolidation of reporting standards in the market. The post also includes a comparative analysis of climate disclosure frameworks in the market, challenges related to sustainability reporting today, ending with a specific case of sustainability information disclosure standards in the Mexican market.

HPL associate, Pedro Paniagua, authored a blog post about the role of financial institutions in the climate transition in LAC. The article offers an overview about the relevance of climate transition and the main initiatives to achieve the net zero economy goal, with a brief focus on LAC markets.

HPL associate, Daniela Canevaro, authored a blog post about carbon credit markets. The article offers a concise description of carbon markets, their origins, their evolution in recent years, and how they are driving sustainable finance in Latin America and the Caribbean.

Alongside the Global Reporting Initiative (GRI), HPL coauthored a study that analyzes the role of impact materiality in the structuring and issuance of thematic bonds. The document compiles perspectives from different actors in the market such as issuers, SPO providers, investors, stock exchanges and multilateral development banks.

HPL Analyst, Natalia Velázquez, authored a blog post on sustainability-linked sovereign financing and debt-for-nature swaps as innovative and effective solutions to finance nature. Natalia explains both instruments using illustrative examples. Furthermore, the article presents the current state of innovative solutions, and future trends on nature finance.

HPL has developed a reference document to guide Financial Institutions in Latin America and the Caribbean in the preparation process for the successful issuance of green bonds. This Guide, prepared under the guidance of the International Finance Corporation (IFC), contains real cases, examples and advanced recommendations on how to approach the steps in preparing a green bond.

HPL Analyst, Sofía Saldívar, authored a blog post on gender-responsive just transition as an opportunity to reduce vulnerabilities and address financial gender equality. The article focuses on the just transition and the role that sustainable finance plays in addressing the challenge of gender inequality through thematic instruments such as gender-focused bonds.

HPL Associate, Virginia Barbosa, authored a blog post on how investment in the bioeconomy can help preserve the Brazilian Amazon forest. The article discusses how bioeconomy is key to help preserve the forest, why it’s in discussion today, and financial instruments that could enable the blossoming of this sector in the coming years.

In this blog post, HPL Associate, Alice Balbé, writes about how nature and biodiversity are increasingly present in finance. The article explores how the recently-launched Taskforce on Nature-related Financial Disclosures (TNFD), contributes to reinforcing the importance of identifying, assessing, managing, and disclosing nature and biodiversity-related risks and opportunities.

HPL Analyst, Brenda Aguilar, authored a blog post on how sovereign issuers can leverage Sustainability-Linked Bonds (SLBs) to drive their sustainability agenda. The article discusses the SLB Principles (SLBP) and their relevance to sovereign issuers, sovereign SLBs in the Emerging Markets (EM), the complementarity of SLBs to Green, Social and Sustainability (GSS) sovereign bonds, and ways to further scale the market.

HPL Associate, Alice Balbé, authored a blog post regarding the growing significance of blue bonds as a financial instrument to support the conservation efforts of our most essential resource, water. The article covers various key aspects, starting with an introduction to finance and the blue economy, followed by a review on blue bonds’ market guidance and definitions. Alice also explains the importance of a blue label to further promote these bonds and summarizes the performance and numbers of blue bonds over time. This financial instrument is gaining momentum and can bring environmental, social and economic benefits while protecting and preserving water.

HPL Consultants, María Teresa Grez, Yvonne Vogt, and Valeria Cantú, co-authored a report alongside the Inter-American Development Bank regarding the issuance of green bonds in the water and sanitation sector in Colombia. The report presents the opportunities of issuing green bonds within the water and sanitation sector by highlighting the consultancy that HPL led with two public water companies in Colombia in their preparation of a Green Financing Framework.

In collaboration with the Water & Sanitation team of the Inter-American Development Bank, HPL drafted a practical guidance document on innovative financing instruments and mechanisms that water and sanitation companies in LAC could use as an alternative or complement to their traditional financing sources. The Guide delves into these instruments’ added value, explains their concept and implementation process, and offers practical recommendations on their structuring, as well as representative case studies that exemplify their application by other entities in the sector in LAC and globally.

Alongside IDB Invest, HPL co-authored a Thematic Bonds Guide, which provides a roadmap for banks and companies in Latin America and the Caribbean looking to integrate ESG investing into their business strategies. The report outlines the five key steps companies can undertake for structuring thematic bonds. The guide is avaialble for download in English, Spanish, and Portuguese.

Alongside IDB Invest, HPL developed a Guide for Voluntary Reporting and Disclosure of ESG Factors for Latinex: Bolsa Latinoamericana de Valores (Panama’s Stock Exchange). The objective of this project was to influence the corporate sector of the country to implement sustainability practices; to inform investor decision making; and create a benchmark that could overtime be adopted by the regulator as national best practice. The guide is avaialble for download in English, and Spanish.

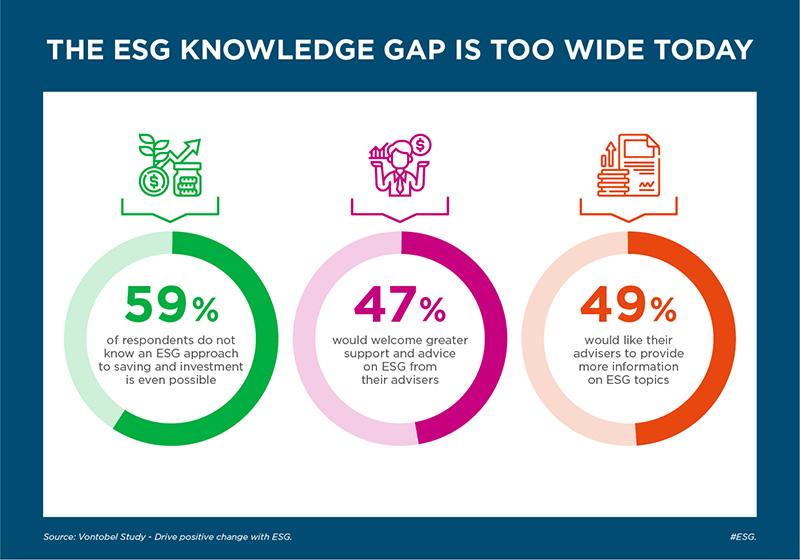

This blog post, co-authored by Isabel Montojo, Associate at HPL; Olga Cantillo, CEO Bolsa de Valores de Panama; and Susana del Granada, Environmental and Social Officer IDB Invest, explores how disclosure and transparency on the management of ESG factors provide companies with added value, as many investors are building investment portfolios with ESG factors where only companies that meet certain criteria are eligible.

This blog post, co-authored by Isabel Montojo, Associate at HPL; Olga Cantillo, CEO Bolsa de Valores de Panama; and Susana Del Granado, Environmental and Social Officer IDB Invest, explores the role of Environmental, Social, and Governance (ESG) disclosure in the emerging markets.

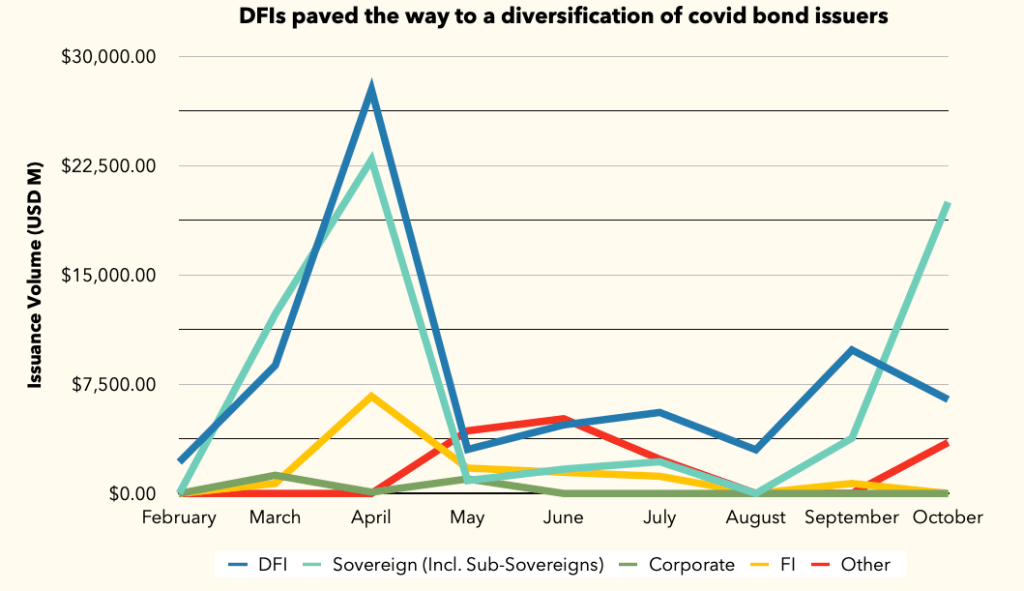

The COVID-19 pandemic has resulted in an unprecedented situation that is severely impacting the daily lives of millions of people globally. In addition to health repercussions, economies and livelihoods all over the world are being challenged by changes in both supply and demand. Governments have scrambled to prepare fiscal stimulus packages and inject liquidity to keep economies afloat.

2020 has seen an explosion of fixed-income instruments, such as pandemic bonds and COVID-19-response bonds, as well social and sustainability bonds with coronavirus response use of proceeds. In order to uncover some market trends regarding these new instruments, HPL collected a representative sample of 100 thematic transactions representing USD 165 bn of social, sustainability, and other coronavirus related bonds issuances.

Biodiversity is a key element to our natural world and the increased agitation of ecosystems in the last decade has posed a significant threat on natural areas and their vast contributions. While most conservation efforts have been funded solely by philanthropic efforts and grants in the past, there has been an emergence of innovative conservation finance instruments. Conservation finance is an emerging field that can unlock private capital and help to continuously scale conservation projects in ways that grants and donations cannot. In this thought leadership, we discuss examples of conservation finance instruments, the different stakeholders involved, and the common themes we have observed in this space.

© HPL.LLC 2026